Create Your Own Legacy!

Making a difference matters to you. Charitable giving is an important part of your life. Like many people, you’d like to know that the causes & organizations that you care about today will continue to thrive for many tomorrows.

The good news is you don’t have to be Andrew Carnegie or Bill Gates to start a meaningful philanthropic legacy. In addition to supporting the work of your favorite organizations through cash donations, consider making a planned gift to the CRi Foundation.

Planned giving is a win-win approach to philanthropic donations that supports the CRi Foundation & can benefit you now or in the future. Have you ever made a vehicle donation to benefit your favorite charity? If you have, you know that transferring assets is easy & it can provide tax benefits as well. Simply put, “planned giving” is the transfer of assets to the CRi Foundation during a lifetime or as part of an estate plan.

1️⃣ PLANNED GIVING IS EASY.

Planned giving is easy to do & you don’t have to be wealthy to do it. Whether it is naming your favorite charity in your will or trust for a modest amount, or a gift of house & property, there is an easy option that is right for you.

2️⃣ PLANNED GIVING CAN INVOLVE ASSETS YOU MIGHT NEVER THINK OF.

A life insurance policy. Real estate. Stocks. Business holdings. A checking or savings account. These are all assets that can be leveraged in planned gifts.

3️⃣ PLANNED GIVING CAN GENERATE AN INCOME STREAM & TAX BENEFITS

In return for the donation of real estate, stocks or other assets, you can receive a series of regular payments. Depending upon the type of gift, short-term and/or long-term tax benefits may apply. Donors at a variety of income levels can benefit.

🙌AND, MOST IMPORTANTLY.. . A PLANNED GIFT IS LONG REMEMBERED.

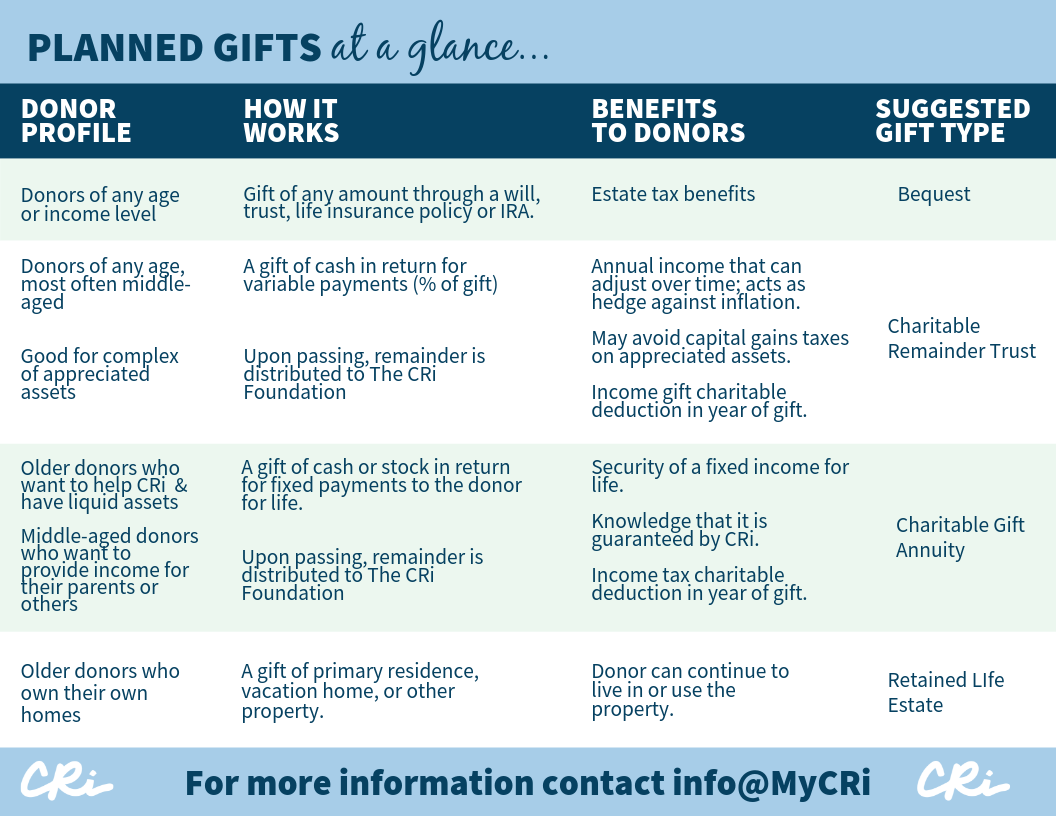

Designating a planned gift automatically makes you a member of CRi's Legacy Society. In addition to the satisfaction of making a meaningful gift, most planned gifts have immediate and/or long-term tax benefits. The chart below can help you find the type of gift that is right for you. Consult with your financial advisor or estate planner & join the CRi Legacy Society today!

We would love to talk more about what type of planned gift(s) might be best for you & your family. For more information about making a planned gift, consult your financial planner & contact AJ in The Philanthropy Department at ajohn@mycri.org or info@MyCRi.org.